Intellectia AI Review 2025

AI-Powered Investment Research Platform for Smarter Trading

Rising Star 2025 Tested for 3 weeks!Introduction

In today's complex financial markets, retail investors face significant challenges when trying to make informed decisions. Professional analysts have access to sophisticated tools and institutional knowledge that individual investors typically don't - until now. Intellectia AI is changing this dynamic by leveraging artificial intelligence to democratize investment research and bring Wall Street-level insights to everyday investors.

Founded in 2023 and headquartered in Hong Kong, Intellectia AI has quickly established itself as an innovative player in the fintech space. The platform uses advanced large language models to analyze stocks, ETFs, and cryptocurrencies, providing actionable insights that were previously accessible only to financial professionals.

After spending three weeks testing Intellectia AI across various investment scenarios and market conditions, we've evaluated its AI capabilities, user experience, and overall value compared to traditional research tools. Whether you're a day trader looking for short-term opportunities or a long-term investor seeking comprehensive analysis, this review will help you determine if Intellectia AI deserves a place in your investment toolkit.

Key Features

Intellectia AI offers a comprehensive suite of AI-powered tools designed to simplify investment research and decision-making. Here are the standout features that differentiate it in the increasingly crowded fintech landscape:

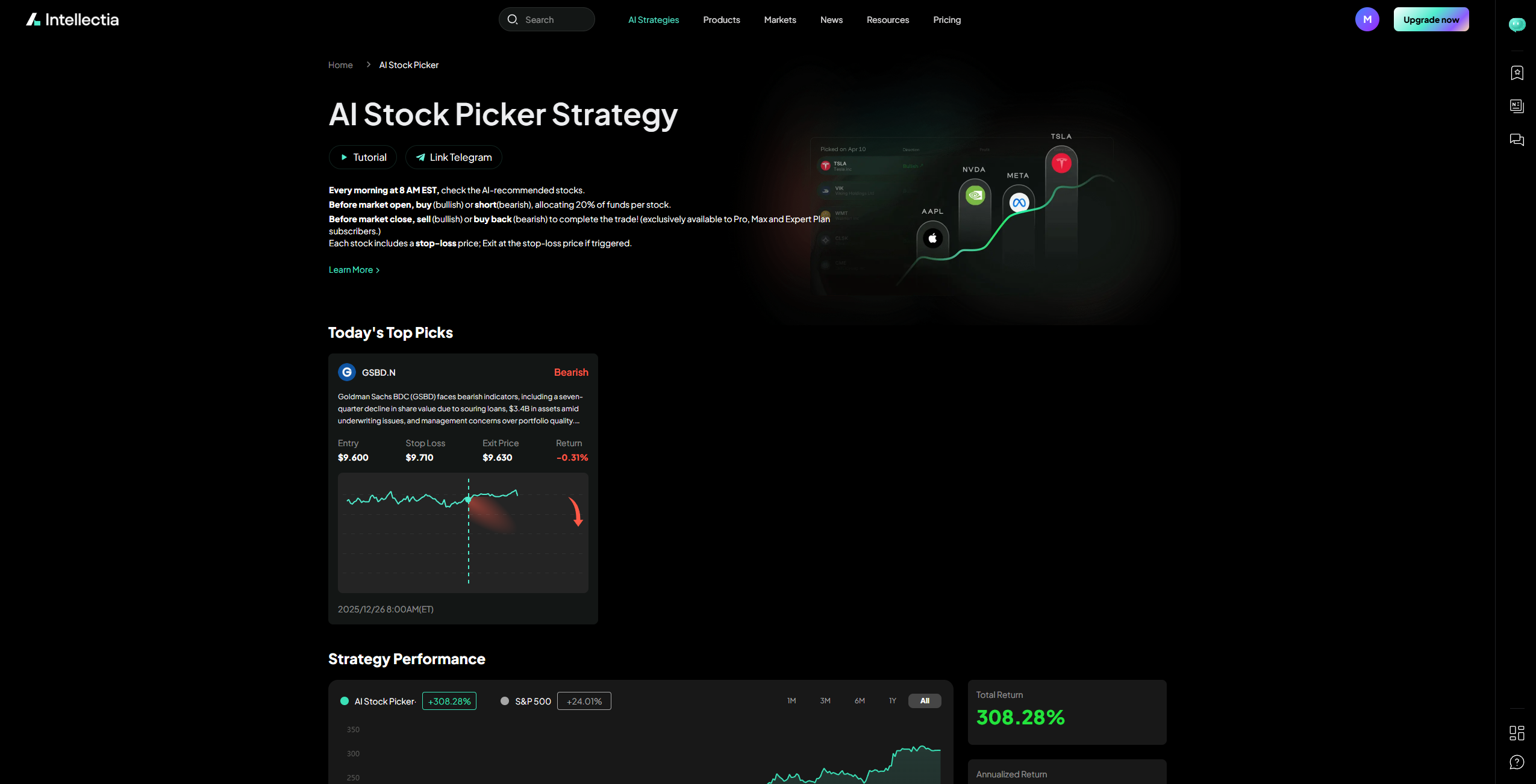

AI Stock Picker

Daily selection of top five stocks for short-term trading potential, updated at 8:00 AM ET, based on technical indicators, market sentiment, and AI prediction models.

One-Click Technical Analysis

Instant, jargon-free technical analysis that demystifies complex trading charts and patterns for investors of all experience levels.

Financial Copilot

An AI-driven Q&A tool that provides data-backed answers to investment queries, from basic questions to complex scenario analysis.

Advanced Stock Screener

Powerful filtering tool for stocks based on criteria like market cap, sector, P/E ratio, and dividend yield with AI-enhanced recommendations.

Crypto Monitoring

Real-time data, charts, and news for cryptocurrency markets with AI-powered sentiment analysis and trend predictions.

Sentiment Analysis

Tracks emotions and opinions from news, social media, and financial sources to identify market sentiment shifts before they impact prices.

Trade Like a Billionaire

Provides insights into the trading strategies of top investors and U.S. politicians, allowing users to track and understand institutional movements.

Cross-Platform Accessibility

Available on web, iOS, and Android devices with synchronized watchlists and alerts for seamless investing on the go.

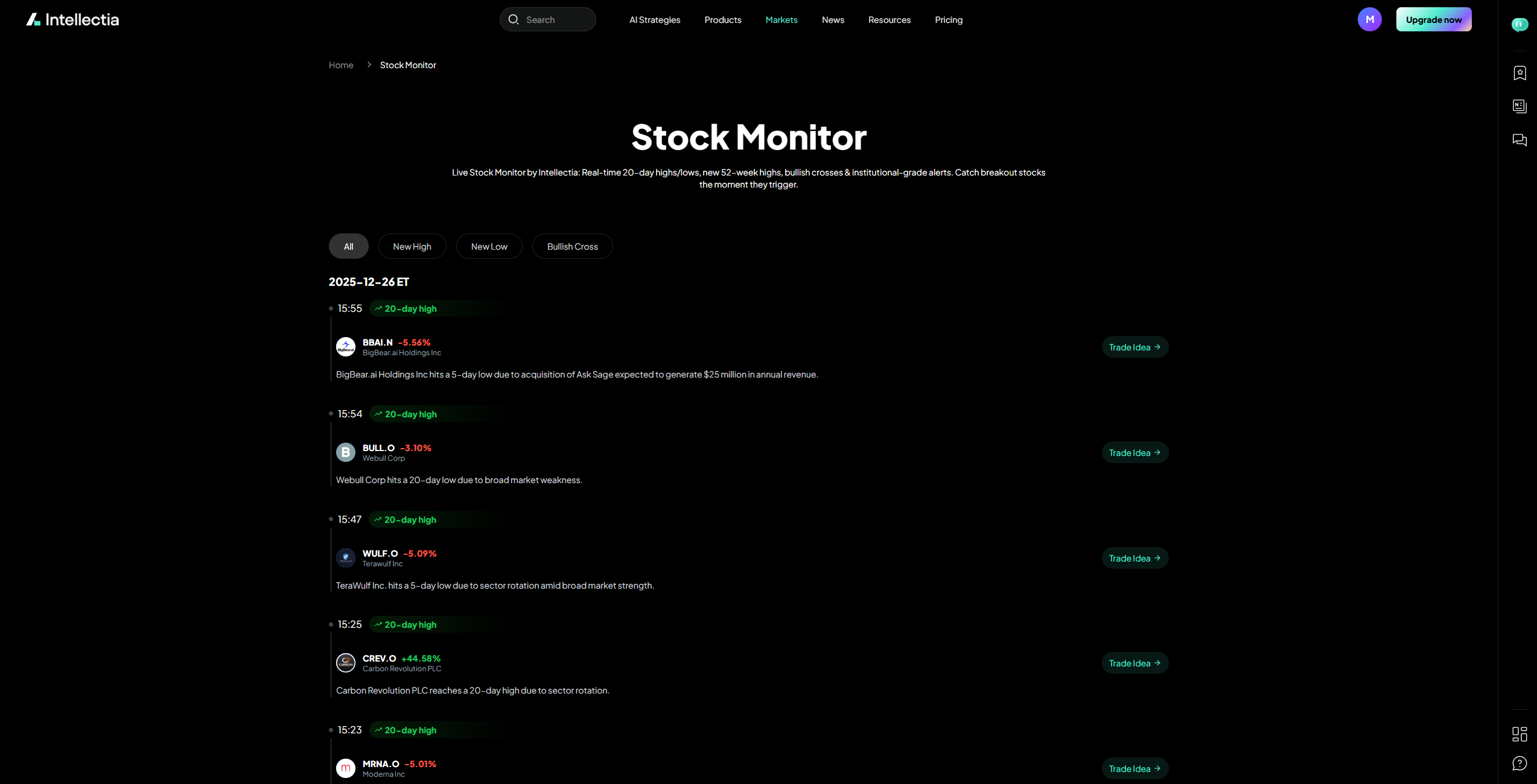

Example: AI Stock Analysis Dashboard

Intellectia AI's comprehensive stock monitoring dashboard provides a wealth of information in a user-friendly interface, combining technical indicators, news sentiment, and AI-generated predictions in one view.

What sets Intellectia AI apart is its focus on actionable insights rather than overwhelming users with raw data. The platform translates complex financial information into clear, jargon-free recommendations that help investors make decisions with confidence, regardless of their experience level.

Pricing

Intellectia AI offers a straightforward pricing structure with three main tiers, plus an accessible trial option for new users:

| Plan | Price | Best For | Key Features |

|---|---|---|---|

| Trial | $1 for 7 days | New users exploring the platform | Full access to all features for 7 days |

| Free | $0 | Casual investors | Limited stock analysis, basic screener, delayed data |

| Basic | $14.95/month | Active individual investors | AI Stock Picker, technical analysis, Financial Copilot, real-time data |

| Pro | $29.95/month | Serious traders and professionals | Everything in Basic plus AI Stock Picker, technical analysis, Financial Copilot, real-time data |

| Max | $49.95/month | Serious traders and professionals | Everything in Pro plus Pattern Signal, S&P Market Signal and increased AI Prompt limits. |

| Expert | $89.95/month | Serious traders and professionals | Everything in Max plus First Priority Support and increased AI prompt limits. |

When evaluating Intellectia AI's pricing against competitors, it offers strong value, especially considering the sophisticated AI technology powering its analysis. Traditional investment research platforms often charge $50-200+ per month for similar capabilities, and typically without the AI-enhanced insights.

The $1 trial represents an extremely low-risk way to test the platform's capabilities, while the monthly subscription model provides flexibility without long-term commitments. Annual billing options are also available with approximately 20% savings.

Ready to elevate your investment research with Intellectia AI?

Try their Pro Plan and get access to AI Stock Picker, technical analysis, and Financial Copilot with real-time market data!

Get $1 Trial TodayPros & Cons

Pros

- Accessible AI insights - Translates complex financial data into actionable recommendations

- User-friendly interface - Clean, intuitive design requiring minimal financial expertise

- Affordable pricing - Significantly less expensive than comparable institutional tools

- Daily stock picks - Consistently updated trading opportunities based on AI analysis

- Comprehensive data range - Covers stocks, ETFs, and cryptocurrencies in one platform

- Low-risk trial - $1 trial provides full access to test all features

- Cross-platform availability - Seamless experience across web and mobile devices

Cons

- Limited historical performance data - As a new platform, long-term track record is still developing

- U.S. market focus - Currently emphasizes U.S. exchanges with limited international coverage

- Basic portfolio analysis - Portfolio management features less robust than dedicated tools

- Occasional AI inaccuracies - AI predictions can sometimes miss market-moving news events

- Documentation gaps - Some advanced features lack comprehensive tutorials

Who Should Use Intellectia AI?

Based on our testing and analysis, here are the types of investors who will benefit most from Intellectia AI:

Retail Investors

Individual investors seeking institutional-quality research without the steep learning curve or high costs of professional tools. The platform's ability to simplify complex analysis makes it ideal for those with limited financial background.

Active Traders

Day and swing traders will appreciate the AI Stock Picker and technical analysis features that identify short-term opportunities and provide clear entry/exit points based on technical patterns.

Investment Beginners

Those new to investing will benefit from the educational aspects of the platform, which explains recommendations and helps users understand the rationale behind trading decisions.

Crypto Enthusiasts

Investors navigating the volatile cryptocurrency markets will find value in the sentiment analysis and specialized crypto monitoring tools that track market mood shifts.

Less Suitable For:

Institutional Investors

Professional fund managers with access to enterprise-grade research systems may find some features redundant

Passive Index Investors

Those following a strict buy-and-hold strategy with index funds may not need the active trading insights

International-Only Investors

Investors focused exclusively on non-U.S. markets may find the current coverage limiting

Intellectia AI in Action

To illustrate how Intellectia AI performs in real-world scenarios, here are some examples from our testing period:

Daily Top Stock Picks

The AI Stock Picker feature provides a daily selection of five stocks with strong short-term potential, complete with reasoning, key metrics, and suggested entry points.

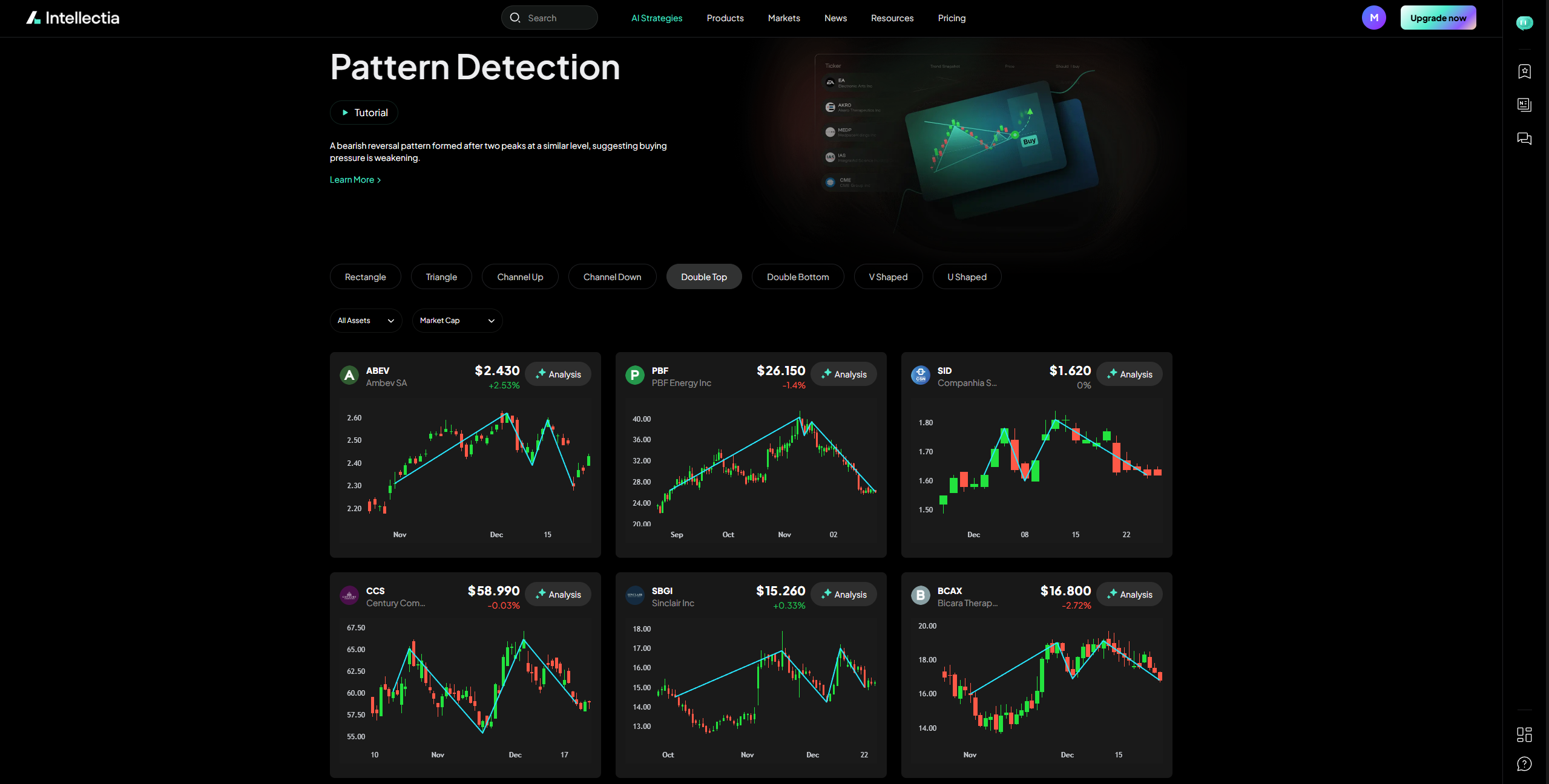

Expert-Level Technical Analysis

The platform transforms complex chart patterns into plain-English explanations with visual highlights of key support/resistance levels and trend indicators.

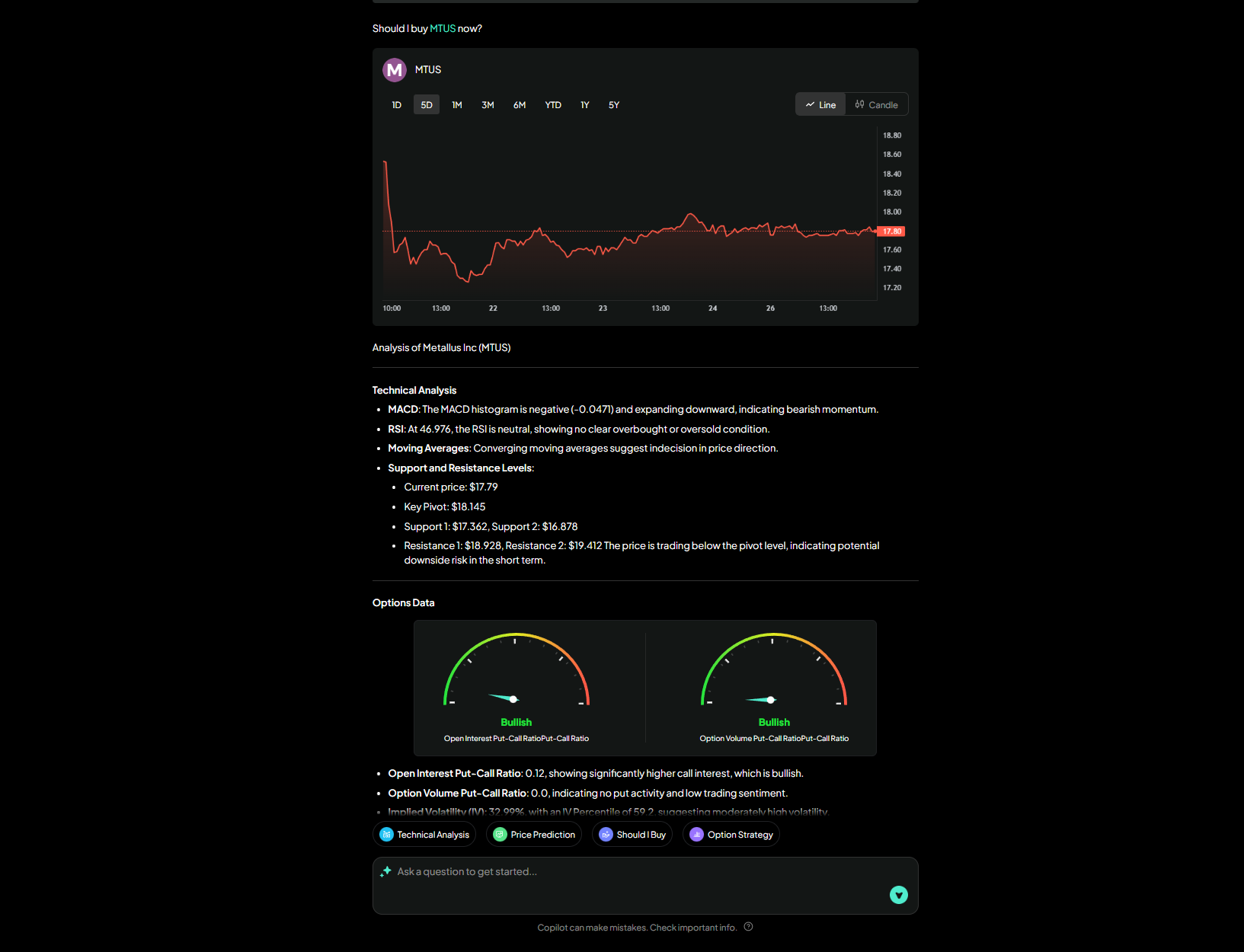

"Should I Buy?" Analysis

When researching a specific stock, the Financial Copilot provides a comprehensive buy/hold/sell recommendation with supporting rationale that considers multiple factors including valuation, momentum, and sentiment.

During our testing, we found the AI predictions to be surprisingly accurate for short-term market movements. For example, the platform correctly identified a bullish pattern in a tech stock that subsequently rose 8.5% in the following three trading days. However, we also observed that the AI occasionally missed the impact of unexpected news events, reinforcing that human judgment remains essential alongside AI insights.

User Experience

Intellectia AI stands out for its clean, intuitive interface that prioritizes clarity over complexity. The dashboard provides a customizable overview of market conditions, watchlists, and AI insights without overwhelming the user with unnecessary data.

Navigation is straightforward with a logical menu structure that separates tools by function (Analysis, Screening, Predictions, etc.). Each section maintains consistent design patterns that help users quickly feel comfortable exploring different features.

The platform's mobile apps deserve special mention for translating the full desktop experience to smaller screens without significant compromises. Synchronized watchlists and alerts ensure you never miss opportunities while away from your computer.

Onboarding is well-executed with interactive tutorials that guide new users through key features. However, we found some advanced functions could benefit from more comprehensive documentation, particularly the custom screening parameters and API integration options.

Performance is generally excellent with minimal loading times for most analyses. The only noticeable delays occurred when generating complex sentiment analyses for high-volume stocks, which could sometimes take 15-20 seconds to complete.

How Does It Compare?

When evaluating Intellectia AI against competitors, it occupies an interesting middle ground between traditional research platforms and newer AI-driven tools:

Intellectia AI vs. TradingView

TradingView offers more advanced charting capabilities and a larger community of traders sharing ideas. However, Intellectia AI provides more accessible AI-driven insights and recommendations without requiring users to understand technical analysis. Choose Intellectia AI if you want clear action items; choose TradingView if you prefer to conduct your own technical analysis.

Intellectia AI vs. Seeking Alpha

Seeking Alpha focuses on fundamental analysis and expert articles, offering deeper dives into company finances and long-term prospects. Intellectia AI emphasizes more immediate trading opportunities with AI-powered technical and sentiment analysis. Choose Intellectia AI for active trading decisions; choose Seeking Alpha for fundamental research and long-term investing.

Intellectia AI vs. Bloomberg Terminal

The Bloomberg Terminal remains the industry standard for professional investors with unmatched data breadth and institutional tools, but at $24,000+ annually, it's inaccessible to most retail investors. Intellectia AI delivers the most essential insights at a fraction of the cost. Choose Intellectia AI for retail-focused research at an affordable price point.

Final Verdict

Intellectia AI represents a significant step forward in democratizing sophisticated investment research. By leveraging artificial intelligence to translate complex financial data into actionable insights, it bridges the gap between professional-grade tools and what's accessible to everyday investors.

The platform excels in providing clarity amid market complexity, offering jargon-free analysis and clear recommendations that don't require advanced financial knowledge to implement. This accessibility, combined with its affordable pricing structure, delivers exceptional value compared to traditional research services.

While some areas still show room for improvement—particularly international market coverage and portfolio analysis capabilities—the development team has demonstrated a commitment to rapid iteration based on user feedback. The platform has already released three major updates in its first year, suggesting these limitations will likely be addressed in future versions.

For retail investors seeking an edge in today's markets without dedicating countless hours to research or paying for expensive professional tools, Intellectia AI provides an impressive balance of sophistication and usability. Its AI-powered insights can complement traditional research methods or serve as a primary analysis tool for time-constrained investors.

With its straightforward $1 trial offer, Intellectia AI presents a minimal-risk opportunity to experience how artificial intelligence is transforming investment research for the better.

Ready to experience AI-powered investment research?

Try Intellectia AI's full platform for just $1 and see how artificial intelligence can transform your investment decisions.

Start $1 TrialFrequently Asked Questions

How accurate are Intellectia AI's stock predictions?

Based on our testing, Intellectia AI's short-term predictions (1-5 days) show approximately 60-70% accuracy for directional movements, which exceeds random chance significantly. Longer-term predictions have lower precision, as with all forecasting tools. The platform is transparent about confidence levels for each prediction and should be used as one input in a broader investment strategy rather than as a standalone decision-maker.

Can I use Intellectia AI if I'm a complete beginner to investing?

Yes, the platform is designed to be accessible to investors of all experience levels. The jargon-free explanations and educational content help beginners understand the rationale behind recommendations. However, it's still advisable to develop basic market knowledge alongside using the tool. Intellectia AI provides educational resources in their Knowledge Center to help new investors get started.

Does Intellectia AI provide portfolio management tools?

While Intellectia AI allows you to create watchlists and track holdings, its portfolio management capabilities are more basic compared to dedicated portfolio tools. You can import your current holdings for analysis and receive AI insights on overall portfolio composition, but features like detailed performance attribution and rebalancing suggestions are currently limited. The team has indicated that enhanced portfolio tools are on their development roadmap.

What exchanges and markets does Intellectia AI cover?

Intellectia AI currently focuses primarily on U.S. exchanges (NYSE, NASDAQ, AMEX) for stocks and ETFs, along with major cryptocurrency exchanges. Limited coverage is available for some international markets, with Asian markets receiving more attention than European ones. The company has announced plans to expand global market coverage throughout 2025, with Canadian and UK markets next in their expansion roadmap.

Can I integrate Intellectia AI with my existing brokerage account?

Intellectia AI offers read-only API integrations with several major brokerages including Interactive Brokers, TD Ameritrade, and Robinhood. These integrations allow you to view your holdings within the platform for analysis but do not currently support direct trading execution. Additional brokerage integrations are being added regularly, with the development team prioritizing based on user requests.